|

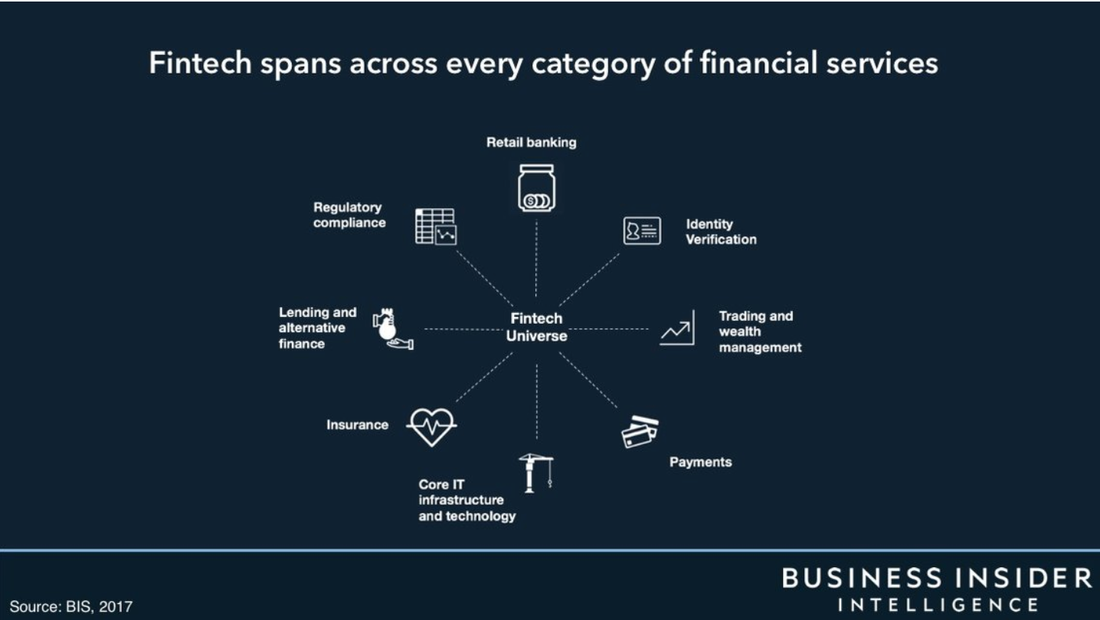

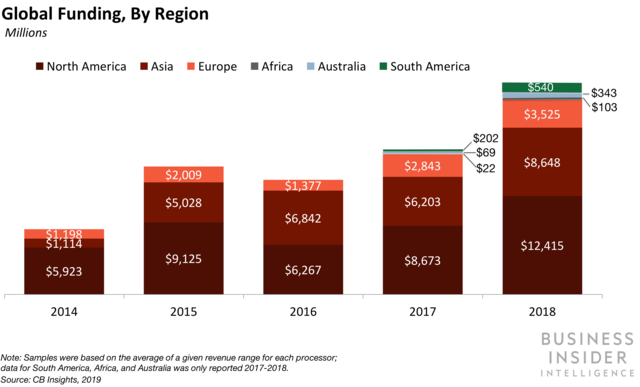

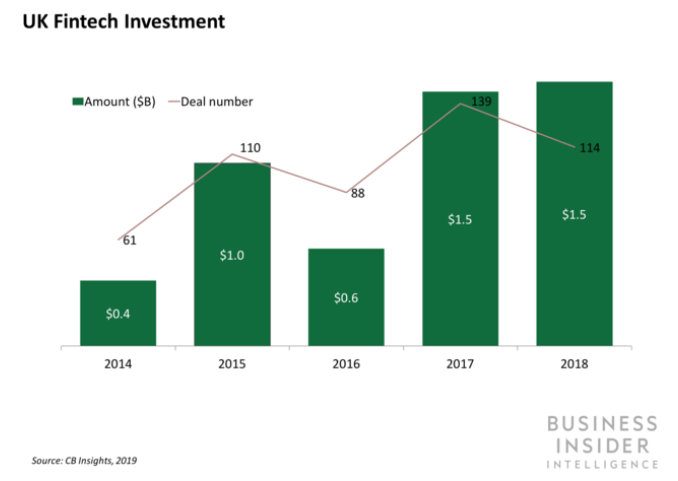

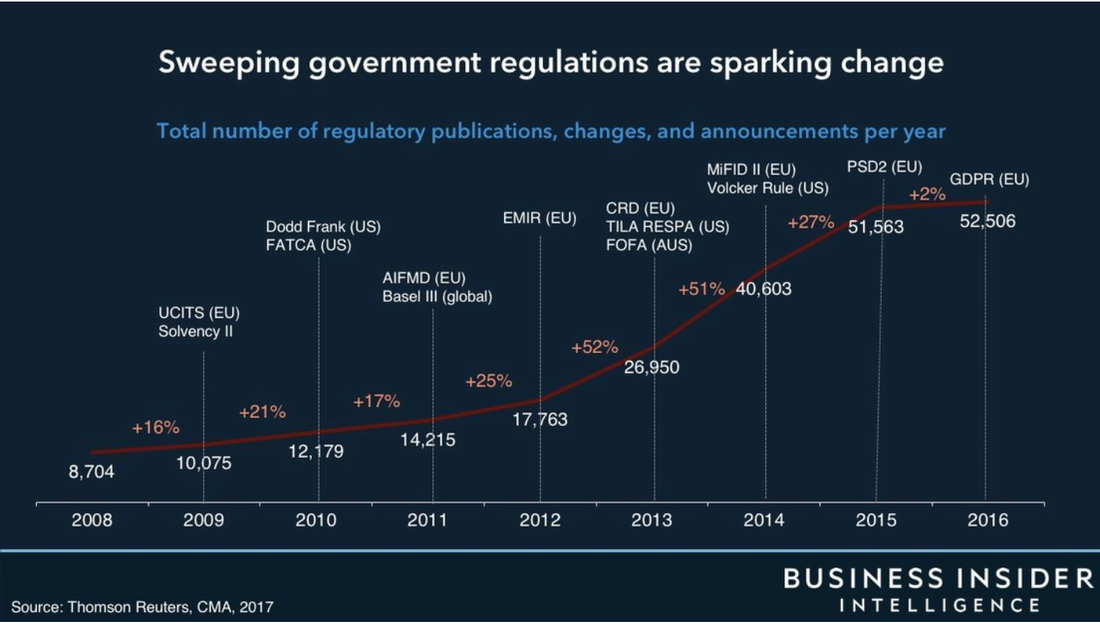

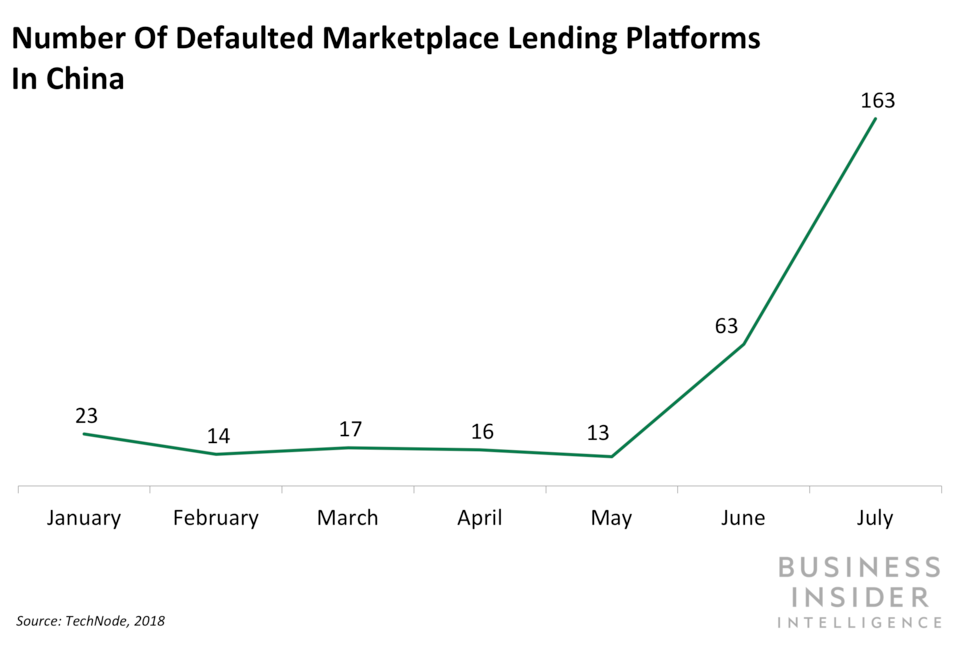

As we head into Q2 of 2019 the term fintech continues to evolve and expand and, depending on who you ask, it’s either the best or the worst time to start a fintech business. FinTechs are expanding into every category of financial services and also creating new ones, through cryptocurrencies (we now have a Crypto Credit Card), blockchain maturity - how else will you track your lettuce? - and even new startup investment offerings. There is also a blurring of the distinction between fintech’s and their financial institution incumbents. This is due to Incumbents acquiring, investing in, or partnering with fintech organizations to support their own strategies, while incumbents are maturing with some beginning to appear more “bank-like” (or at least in the case of Robinhood maybe biting off a little more than they can chew). With this expansion, crowding and competitiveness also follow. Especially as tech giants such as Apple continue with their expansions and Facebook look at raising $1 billion for its new cryptocurrency project. Any stand-out success in the upcoming year will require significant partnership and investment to really compete (as well as a product solving some really interesting problems). Here are a few trends we see, and also hope to see, happen for the remainder of the year. FUNDING Let’s start with Money. Investor interest in FinTech is very much on the rise globally. Investment in ASEAN countries in 2018 will exceed the $5.7 billion invested in 2017 by 20% to 30%. Outside of traditional VC and Private Equity money, Banks and more traditional Financial Institutions are also investing in FinTechs with BPCE, RBS, and Barclays all making significant investments in 2018. DIGITAL ASSETS 2018 dubbed was the “Crypto Winter”, with Cryptocurrencies prices and the popularity of ICO’s plummeting. While this trend may remain the same for the general public in 2019, this is not the case for financial institutions, who seem to be investing heavily into tech for the digital asset market with startups securing $850 million across 13 deals in VC funding year to date (per PitchBook data). The SEC also has Crypto lawyers hard at work trying to determine whether their “plain English” guidance on ICO’s and Tokens clarifies things or just muddies them further. On the flip side of this China is cracking down on Cryptocurrency and Token-based activities — banning ICO’s last year and just recently cracked down on Cryptocurrency mining. Best bets in this space remain with Blockchain tech, which is starting to gain serious industrial momentum. Many Financial Institutions have been busy experimenting with blockchain solutions to solve a variety of pain points in the industry. We’ve seen these early experiments begin to bear fruit in 2018 and 2019 should see some of these solutions really start to mature. With IBM’s Food Trust, for example, who counts Walmart, Kroger, Nestlé and Carrefour, among its 50-plus members. CHANGES IN REGULATION It’s not just the SEC, but big battles are upcoming in the US as Washington tries to figure out what, if any, regulation is needed to reign in technology platforms (such as Facebook and Twitter). Meanwhile in the UK hiring growth numbers could be dampened by Brexit and uncertainty surrounding it. Especially as 25% of IT professionals come from outside the UK (FinTech salaries have also increased between 6% and 8%, likely as FinTechs in the UK strive to stay an attractive option for the right tech talent). In addition, the UK Financial Conduct Authority (FCA) proposed regulatory changes that would limit marketplace investors on lending platforms to be certified (read: high-net-worth) investors, and also restrict their investments to less than 10% of their net assets. This will create a bunch of investment pressure that will likely result in a number of marketplace lenders shutting down. And it’s not just large political regulatory changes that impact fintech, it’s the increase in frequency. Check the chart below for the year-on-year increases in financial regulatory activity globally. Which explains, in some part, why partnering with tech companies is a solid strategy to help tackle regulatory hurdles that legacy incumbent technology stacks may not be able to address. ASIA MAY RULE San Francisco still leads the pack when it comes to FinTech investments overall, followed by the UK, which last year saw a 61% increase in fintech job creation and is threatening to take San Francisco’s crown if regulation doesn’t impede progress. However, earlier this year in an annual letter to shareholders, JPMorgan Chase CEO Jaime Daimon said, “it’s hard not to be both impressed and a little worried,” about China’s progress into the AI and fintech sectors. According to a report from Robocash, SouthEast Asia remains the best market for FinTechs, at least for near term developments. NEOBANKS

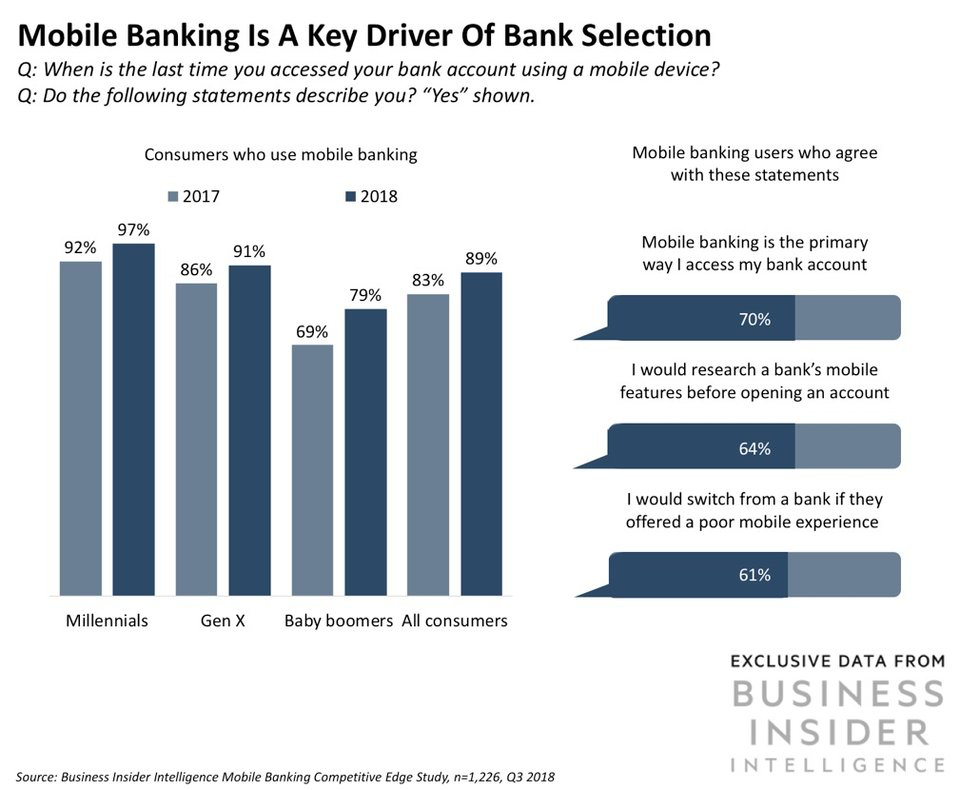

The rise of Neobanks will continue to strengthen — particularly in Europe, with success stories such as Tide and Starling and others like Tandem and Monzo who are looking to diversify their offerings. Some of these well established European challengers like Germany’s N26(currently with 2.5 million users) and the UK’s Revolut, as well as Israel’s Pepper, are all looking at capitalizing globally, and in particular with expansion into the US market, which now houses a much friendly regulatory environment for non-incumbents to obtain banking licenses, and with mass adoption of mobile-friendly banking services, the market is starting to catch up with other regions, with companies such as Chime, which now has over 2 million accounts and adding more customers a month than Wells Fargo or Citibank and Finn, which is a spin-off from JP Morgan Chase.

0 Comments

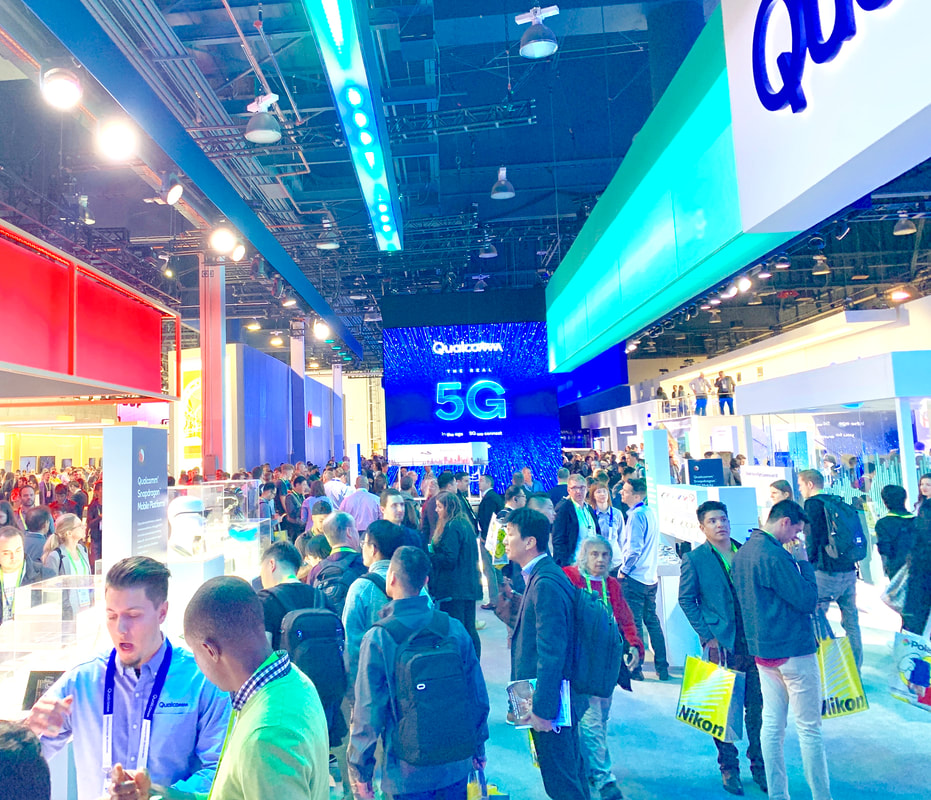

Every January brings with it the Consumer Electronics Show (CES) in Las Vegas. Bringing in an estimated 180,000+ people, it’s one of the biggest technology shows in the world with all kinds of tech companies ranging from small startups to big brands showing off their best tech and ambitions for the coming year. Through all of the spectacle, flashy lights, and gadgets, the show also offers a deeper insight into industry trends, emerging technology, and future shifts. The 2019 show saw a lot of “more of the same” but the key difference this year seems to be most of these trends are ready to go (and many partnerships with Amazon, Google and Apple exist). Here are my key takeaways: 5G — The Key Future Ingredient 5G networks are here with the first US network to go live in the next couple of months. This new cellular standard has plenty of people buzzing (including me) that this is the next big thing to bring around a large incremental step in technological advances — in the same way that 3G enabled the rise of the Smartphone. The lightning-fast networks will change how telecommunications shapes business and consumer behavior. 5G isn’t an incremental bump to cellular network speeds, it can provide ten times faster speeds, fifty times lower latency, and a tenfold advantage in terms of the number of connected devices it can support, it’s a triple whammy. This has massive implications not just for the mobile phone industry — who definitely see it as the next big thing — but also with commercial and industrial IoT, self-driving vehicles, health, and Smart City initiatives. AT&T, T-Mobile, and Verizon made big announcements on their 5G networks (some of them “fake” 5G) while Sprint, Intel and Qualcomm announced a range of devices for mobile devices, vehicles, and laptops. Voice — everywhere In the last two years of CES, Google and Amazon have really shown up, pushing their personal assistants and voice-controlled devices both inside and outside the show floor at various booths and displays, signaling that digital assistants haven’t just reached the mainstream but are becoming ubiquitous. There were no remarkable announcements made at CES but given the rapid year of adoption we have seen with Alexa, Google (and Siri and Cortana to a lesser extent), it is definitely prime time for Voice based computing. I saw plenty of smart home products and consumer partnerships with Google and Alexa. Every product seemed to have a voice assistant, including Cars… Vehicles As we noted in at last years Show, cars are now front and center at CES and the transportation industry is now firmly part of the tech industry. Ford, Mercedes, Toyota, Nissan, Kia and just about every other major car manufacturer have lavish booths and futuristic designs on display at CES and are occupying more and more of the showroom floor each year. But even in Vehicles, Google and Amazon are there and it seems to be the next major competitive arena for Voice Assistants (Editors note: Yes I have already pre-ordered my own Alexa Car Assistant). Lyft was also at CES in a partnership with Aptiv, providing self-driving transportation experiences at the conference and BMW was providing real and virtual test drives - I got to drive an M5, X7, and an i8 Byton! Seemingly out of nowhere (well OK, they were at CES last year). They are one of the few automotive/EV companies trying to totally re-imagine what the inside of a car should look like if and when they become fully autonomous right now — their current iteration involves at least 5 touchscreens, including one that spans the entire windshield. And we can’t talk about vehicles at CES without also mentioning the flying kind. Uber’s has a big air taxi initiative with Bell Aerospace unveiling the latest prototype of the Nexus VTOL aircraft called Elevate (aka the Uber’s air taxi) The prototype on display isn’t operational, but Bell hopes to begin testing in 2020 and are working with the FAA to develop all the relevant regulations!

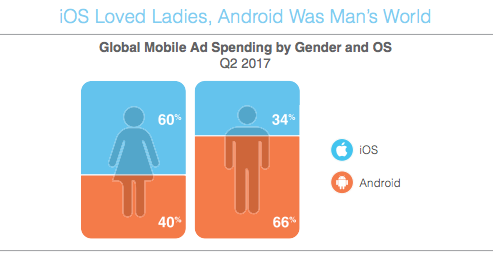

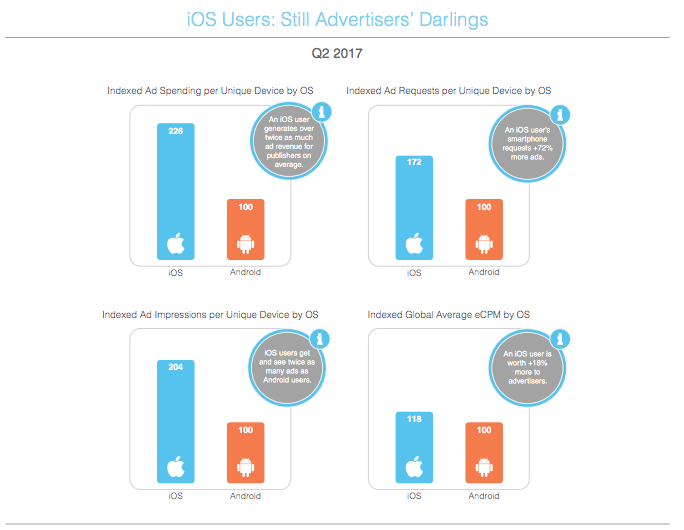

Mobile advertising company, Smaato, published a report earlier this month that highlighted global trends in mobile ad spend, analyzing an impressive 1.5 trillion ad impressions. Here are some top takeaways:

|